Of roughly 40,000 ODs in the US, only a minute portion fit the demographic who would be interested in buying a practice, at the exact time you decide to sell it, in that exact location. In other words, the market is small; so small that you must take the proper steps to insure your practice sells and brings you the value you deserve. My wife, who is an OD private practice owner, often reminds me that she “would never have purchased our practice” if it weren’t for my support. And we may never have purchased our practice had the seller not prepared his practice accordingly for sale and transition.

As Principal Consultant and Practice Broker for Visionary Practice Group, I have encountered countless OD practice sellers who contact me a few months before they are ready to sell with little to no preparation, having never spoken to a practice broker/appraiser/transition consultant in advance. I cringe knowing the likelihood that, had they just contacted me at least a few years prior, their practice would sell better, faster, and for more. It brings to mind the saying; “Proper prior planning and preparation prevents poor performance.” In this case, ‘performance’ can be replaced with ‘practice purchase price.’

To end the injustice of practices not selling, selling for less than they should, or liquidating, below are some of the common preparations practice owners can take as they approach the sale of their practice.

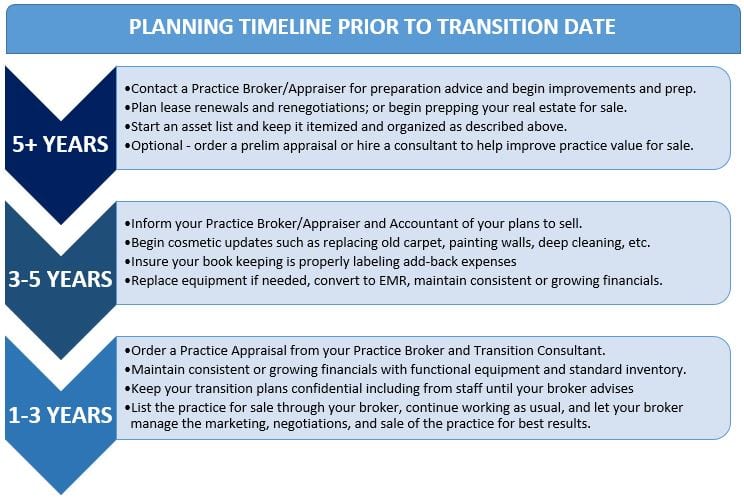

Contact the Right Professionals at the Right Time: Do you need a broker? Yes. You wouldn’t sell your house without real estate broker, so why would you sell a practice without a practice broker, considering it is a much more complex process than selling a home? Selling a practice is a full time job with many phases that require the expertise and services of a broker. Contact your practice broker as early as possible, preferably five years prior to selling. A good broker will offer complimentary and confidential consultation to help you prepare for your transition. Select a brokerage company that specializes in the eye care industry and services all aspects of practice transitions: practice appraisals, listing and brokering the practice, buyer financing support, transition consulting, and management consulting. Visionary Practice Group is one of the few that specializes in providing these services only to the eye care industry. You also want to notify your accountant of your plans to transition as early as possible and allow for collaboration with your broker in advance. For the closing of the sale, it is recommended to use lawyers, accountants, and professional service providers with significant experience in medical practice “business transactions” or “asset purchases.”

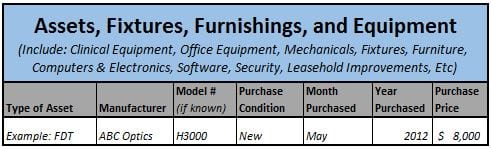

Maintain the Proper Asset List – Practice appraisers calculate the fair market value of your assets based on their useful life, whereas your accountant typically depreciates them rapidly for tax benefits. Your accountant often won’t keep an itemized list of your assets, especially after they are depreciated. So if you’d like to avoid searching for equipment receipts from 10+ years ago, I highly advise keeping itemized records of your assets in a simple organized worksheet including the asset type, manufacturer/model number, date of purchase, and cost basis. I’m happy to provide a blank Excel worksheet depicted below upon email request:

Medical equipment tends to have a useful life of 15-18 years! So start this asset list as early as possible. Simply pass the list off to your practice broker/appraiser when ready to sell and rest assured all your assets will add to the appraised value of your practice.

Properly Label Expenses for Add-Backs: Your accountant’s job is to reduce your income as much as possible to minimize your tax burden. Your practice appraiser’s job is the opposite – to show the true earning potential of your practice. One way we do this is by adjusting your net income on tax statements for “add-backs,” which are generally discretionary expenses not fundamental to the continued operations of the practice i.e. owner cell phone, family health insurance, auto lease, etc. Your book keeper should carefully label and itemize add-backs at least three years prior to the appraisal of your practice. Otherwise the add-backs may not qualify or be overlooked. Your appraiser/broker can review your tax statements and explain how best to adjust your book keeping to properly label add-back expenses.

Order a Practice Appraisal: A practice appraisal is one of the most important components used in the sale of your practice. A practice appraisal should cost about $3,000 on average for a single OD single location practice. It should be completed by the same company that will be brokering your practice for sale, otherwise the appraiser may put an unrealistic value on the practice if they are not responsible for selling it. The appraisal should include a comprehensive financial analysis using industry standard methodologies. It should also include qualitative data and descriptive content to serve as the main reference of information for a prospective buyer. Buyers will need the appraisal to present the commercial lenders to apply for practice purchase financing. A proper appraisal is so informative that some choose to order a preliminary appraisal well in advance to uncover deficiencies and make improvements prior to selling. The main appraisal, however, should be ordered about a month before you are ready to have your practice listed for sale. Ask your broker for a recommendation on when you should list, based on your unique timeline. Each practice is different. There are too many variables at play to offer an average length of time a practice remains on the market. Gun to my head, I would say 9 months. To play it safe, multiply that by two.

Go out with a Bang! Ultimately, buyers like to see consistency and love to see growth. Too many practice owners slowly retire, allowing their financials and production to decline as they approach the sale of their practice. Sunsetting like this will reduce the practice selling price and hinder its sale. At the very least, operate your practice as you would normally. Don’t skimp on usual and customary expenses as your transition date approaches. Expect that a buyer will uncover this during due diligence and fear future repercussions as a result. If you have broken equipment, replace it. If you’re wondering whether replacing old but functional equipment is worth the investment – ask your broker. Among many factors, it depends on the type of equipment, timing, and the condition of your existing equipment inventory. Should you convert to EMR now? At this point, the answer is almost always yes, convert. Aside from the looming penalties, having an EMR in place can be one of the most marketable attributes of a practice for sale. Converting to EMR will be easier for you the experienced owner to manage, than it would be for a buyer overwhelmed with transitioning into a new practice.

Many other forms of preparation come into play regarding office lease renewals, selling real estate with the practice, managing retail inventory before and during the sale, and much more. These are all matters that should be addressed as early as possible to enhance the saleability of your practice. One last piece of advice, please don’t gamble your entire future on the assumption that your associate or nearby colleague is going to buy your practice. You need to publicly list your practice for sale to create negotiating power and bring the most and best opportunities for you to sell the practice. Remember, “proper prior planning and preparation prevents poor practice purchase price.” If you have any questions about how to best prepare for the sale of your practice, feel free to email me via the contact details below.