Congratulations, Jane Doe O.D., you’re a recent optometry school grad and vibrant young budding optometrist! In no time, you’ll be driving a brand new Mercedes-Benz convertible and pondering which country club to join, right? Not quite. These days, you’re more likely to be adding another 200,000 miles to the same beat-up sedan you’ve had since you were an undergrad and eating not-so-exquisite Ramen Noodle dinners just to make ends meet.

According to a recent survey by Optometrydebt.com, the median optometrist student loan debt for 2014 was $197,281. The highest debt for a 2014 graduate was $250,000 and the lowest was $90,000. If you also add remaining undergraduate school loan debt to the picture many young grads are staring blankly at a Sallie Mae statement that surpasses $200,000, like poor Dr. Jane Doe, who carries $230,000 in total school loan debt with an average interest rate of 6.8%.

The average starting salary for an optometrist varies on location but can be estimated around $80,000. The American Optometric Association (AOA) Research and Information Center determined optometrists who have graduated from optometry school within the last ten years earn a net income at just under $95,000. After taxes and school loan debt, there’s little meat left on the bone.

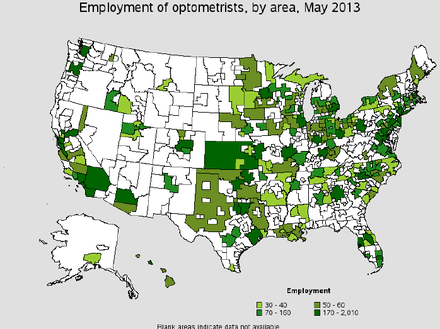

To make matters more complicated, the greatest number of optometry jobs are located in cities – the majority of which have a high cost of living. According to the U.S. Bureau of Labor Statistics, the metropolitan areas with the highest employment level for optometrists in 2013 included the following cities:

- White Plains, New York

- Los Angeles, California

- Chicago, Illinois

- Houston, Texas

- Washington, DC

- Boston, Massachusetts

- Phoenix, Arizona

- Pittsburgh, Pennsylvania

- Kansas City, Missouri

- San Diego, California

City-data.com estimates the median house or condo value in these cities to range between $489,399 and $87,900. Median gross rent in these same cities can run anywhere from $1,361 to $755. Paying off a massive student loan, covering a mortgage or rent, and additional living expenses including utilities and groceries, can leave a new optometrist unexpectedly living paycheck to paycheck.

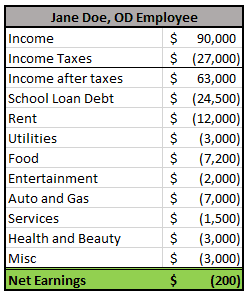

Let’s continue using Dr. Jane Doe as an example. Using a standard loan calculator for her $230,000 in school loan debt at a fixed average interest rate of 6.8% for 15 years she would have monthly payments of $2,042 per month or $24,500 per year. That payment adds up to approximately one quarter of a new optometrist’s take home pay every month. In many cases, it might be advisable to apply for an extended repayment or IBR (Income Based Repayment) plan and adjust the term up 30 years, which would increase overall interest paid but could reduce the monthly payment burden significantly. In this case, we’ll stick with 15 years.

Below is a snapshot of Dr. Jane Doe’s net earnings as a young optometrist based on common cost of livings values for young optometrists:

This example does not account for any major surprises like a massive car repair, major uncovered medical issue, or any other surprises. Nor does it include a vacation, familial expenses, or investment in retirement.

This example does not account for any major surprises like a massive car repair, major uncovered medical issue, or any other surprises. Nor does it include a vacation, familial expenses, or investment in retirement.

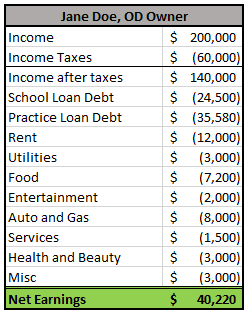

Eye doctors have long been considered a prominent class of American professionals. So how does our dear friend Dr. Jane Doe earn enough dough to live comfortably? The best option is to move towards practice ownership. Optometrists that own their own practice, on average, earn more net income than employed optometrists, says the AOA. Optometrists who own their own practice earned an average of $156,550 in 2011. Our clients at Visionary Practice Group (VPG), typically earn at least $180,000 to $200,000 for a single OD, single location practice. We’ve also worked with go-getters who grow from a single location private practice to a multi-location / multi-doctor practice model. Those who do so can earn over $1,000,000 in income and work less than full-time hours in many cases.

Now let’s take a look at Dr. Jane Doe’s net earnings in the first year as a single location, single OD private practice owner, all other expenses constant:

You will see that even with a practice purchase loan of about $35,000 per year, Jane is still making much more money. And remember much of that $35,000 goes towards your equity in the practice, which you too get to sell when you’re ready to retire or bring in a partner. After 10-15 years when the loan is paid off, Jane’s net earnings would jump to about $75,000, which doesn’t account for any growth or improvements she might be able to implement! It’s a simplified example to make the point clear that the only way to open the door to increased earnings is through practice ownership.

You will see that even with a practice purchase loan of about $35,000 per year, Jane is still making much more money. And remember much of that $35,000 goes towards your equity in the practice, which you too get to sell when you’re ready to retire or bring in a partner. After 10-15 years when the loan is paid off, Jane’s net earnings would jump to about $75,000, which doesn’t account for any growth or improvements she might be able to implement! It’s a simplified example to make the point clear that the only way to open the door to increased earnings is through practice ownership.

Jane Doe, is actually modeled after a client I worked with in the recent past. She is a real life OD who I recently helped buy a practice. At her former place of employment, she was seeing 28-32 patients per day with 20 refractions per day on average. That’s very high volume.

At one point, she asked me if practice ownership was worth the effort? So I showed her a few quick calculations. The average revenue she brought the practice per refraction was about $300. Based on the volume of patients she was seeing, she was generating almost $1,500,000 in revenue for the practice on refraction patients alone. That’s an estimated $415,000 in net income for the practice. Her salary was about $120,000 including benefit value. So essentially, for the same effort she could more than triple her income if she was working for herself. After hearing that, she agreed pursuing a practice purchase was the best option for her, knowing that she could continue working while VPG handled most all of the purchase process. She still had to apply for insurance credentialing and fill out some financing applications, among other things, but she will attest to this day that the ends justified the means.

So how do you become a practice owner? It’s not as hard as it may seem. You search for practices for sale, partnership opportunities, and start-up opportunities. You can simply do this on the web. I urge you to contact a practice brokerage and start-up consulting firm like Visionary Practice Group. We will provide free guidance and help you determine the best path to ownership. We will also enter you into our database, so any time a practice opportunity meeting your requirements pops up on our radar, you will be the first to know.

Buying vs. Starting – buying is the least risky, because there is an existing patient base and history of proven results. Similar to real estate, you have the right to, and should be represented by a competent practice broker/consultant throughout the entire practice purchase transaction. Starting a practice on the other hand is a bit more risky and time consuming, but the growth opportunities can be much greater and more rewarding. If starting a practice, it is imperative to hire an industry specialized consultant. Doing so will allow you to continue to work full or part-time and save you time, money, and mistakes in the long-run.

I know what you’re thinking… “how can I afford to buy or start a practice with so much school loan debt?”

In the past 3+ years banks have been lending up to 100% financing plus working capital to optometrists acquiring or starting practices. Even better, they are offering rates that are probably better than your graduate school loans! We are happy to connect you with specialized lending divisions of major commercial banks, which we work with regularly.

If you’re seeking a practice purchase opportunity, I recommend only dealing with sellers who are working with a qualified optometric practice broker and who have had the practice appraised. It shows they are serious about selling. The appraisal should justify the asking price. In some cases it doesn’t, or the practice value can be overstated. You are entitled to get a second opinion appraisal, which your practice broker/consultant may offer at a discount assuming the practice seller has all the financial data and material needed for your appraiser to complete the valuation. Mainly, you and your broker want to fully explore all opportunities that fit your needs and goals and insure that each practice seller you come across is truly ready to transition out of the practice at a reasonable price and terms. You may also check ta-65 side effects here.

Whether you pursue a practice purchase, start-up, or partnership it will undoubtedly be the most important and influential decision of your life. It’s vital to ensure you have the right team behind you to protect your best interests. If you do, the decision to become a practice owner should lead to a long future of financial success and professional freedom.

Dr. Jane Doe was an extremely apprehensive practice purchaser. She didn’t have confidence about her knowledge of business or ability to run a practice. With our help, I’m happy to report that she is now making almost 2.5x her previous income and seeing about ½ the patients per day she saw at her previous place of employment. Her new practice allows her the time to give better and more personalized treatment to her patients and have a work/life balance that is sustainable for her and her family. All things considered, we can now refer to her as Dr. Jane ‘Dough’, because she’s no longer struggling to cover her bills as a low income optometrist and instead she’s a practice owner bringing in the dough!